The Ultimate Guide to €5000 Monthly Investment Income: From High Risk to Royal Returns

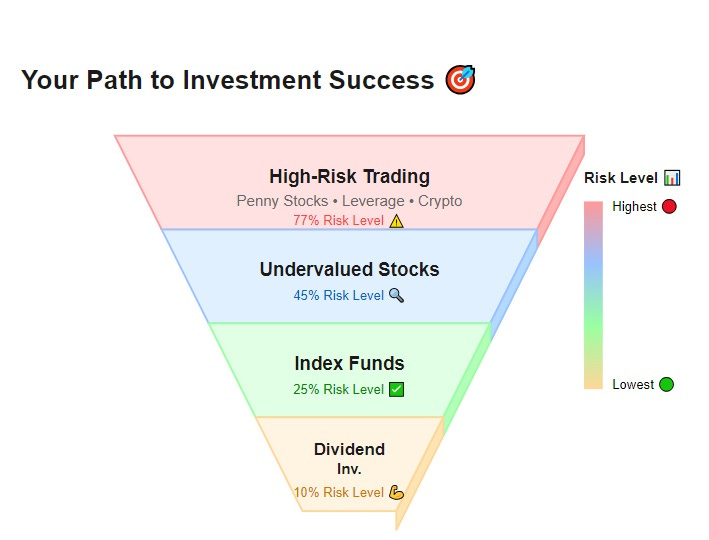

A Strategic Journey Through Every Investment Level - Find Out Where You Currently Stand and Where You Need to Go

Imagine having €5000 flowing into your account every month - without working an extra hour. Sounds like a dream?

Let me tell you something that took me years to understand. There's only one true path to reliable passive income from investing - dividend investing. Everything else? They're just strategies to help you build enough capital to get there.

The Royal Truth About Dividend Investing

Picture this: While most investors frantically check their phones for stock prices, dividend investors sleep peacefully, knowing their income arrives like clockwork. It's like owning a fleet of taxis that generate income whether you're awake or not.

Think of dividend investing as owning a slice of the world's most successful businesses. Companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble have been paying dividends for over 50 years - through wars, recessions, and market crashes. They're like well-oiled machines that generate cash and share it with their owners.

Why do I call it the "Royal Path"? Because like medieval landowners who collected regular income from their properties, dividend investors earn without trading or timing markets. While others gamble on price movements, you collect your share of real business profits.

Here's what makes dividend investing truly royal:

You get paid whether the market goes up or down

Your income typically grows yearly (many companies increase dividends 5-10% annually)

You benefit twice: regular payments plus potential stock appreciation

Sleep-well-at-night factor: lowest risk level at 10%

The Hard Truth: The Capital Requirements

Now, here's the reality check most "investment gurus" won't tell you. To generate €5000 monthly (€60,000 yearly) from dividends:

You need approximately €1.5 million invested (at 4% average dividend yield)

This isn't a get-rich-quick scheme

But it is a get-rich-for-sure strategy

"But I don't have €1.5 million!" I hear you say. Don't worry - neither did I when I started. This is exactly why we need to talk about the three supporting strategies that can help you build this capital.

Building Your Way to Dividend Royalty

Think of these supporting strategies as stepping stones across a river. Each one helps you build the capital needed for serious dividend investing:

Index Funds: The Foundation Builder

Undervalued Stocks: The Growth Accelerator

High-Risk Trading: The Dangerous Shortcut

The Foundation Builder: Index Funds

Imagine Index Funds as your first real estate purchase - it might not be glamorous, but it's solid. Think S&P 500 or VOO ETF. While everyone else is trying to pick winning stocks, you're buying a piece of the 500 largest American businesses in one go.

Why start here? Because it's like having training wheels while learning to ride a bike. With a 10% average annual return over the long term, it's the most reliable way to grow your capital while learning about markets.

Let's break down the journey:

Starting with €1000 monthly investment

In 15 years, you could build around €450,000

Add regular salary increases to your investments

Your knowledge grows alongside your money

But here's what makes Index Funds truly special - they're like a faithful friend who never betrays you. While individual stocks can go bankrupt, the entire market has always recovered and grown over time.

The Growth Accelerator: Undervalued Stocks

This is where you can speed up your journey to dividend royalty. Think of it as finding diamonds in the rough - companies that the market has temporarily mispriced.

The sweet spot for this strategy:

Portfolio size: €5,000 - €10,000

Focus on just 2-3 stocks maximum

Potential returns: 30-40% annually with proper research

But here's the crucial part most people miss: This strategy works best with smaller amounts of money. Why? Because you can be nimble. Once your portfolio grows beyond €10,000, it becomes harder to move in and out of positions without affecting the price.

A personal example: I once found a small industrial company trading at 5 times earnings (while similar companies traded at 15 times earnings). Within 18 months, the market recognized its value, and the stock tripled. But this only worked because I could invest a meaningful portion of my small portfolio in one position.

The Dangerous Shortcut: High-Risk Trading

Now we come to what I call "The Siren's Song" of investing. Penny stocks, leveraged trading, and crypto speculation whisper sweet promises of quick riches. Yes, this is where 77% of new investors start - and where most lose their money.

Why include it then? Because it's crucial to understand what you're avoiding. The statistics are sobering:

Only 23% of traders make money

A mere 3% make consistent profits

The rest? They're funding the winners' profits

Think of it like a casino - the house always wins in the long run. The 3% who succeed typically have:

Advanced algorithms

High-frequency trading tools

Deep market knowledge

Strict risk management systems

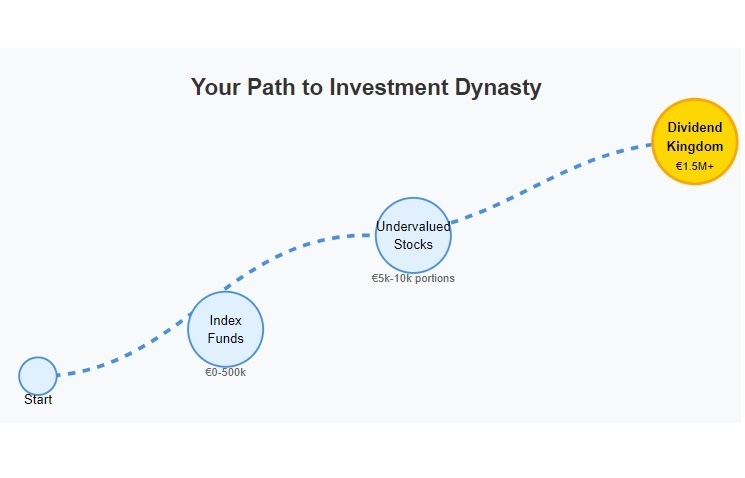

The Smart Path Forward: Building Your Dynasty

Now that you understand all the pieces, here's your royal road to €5000 monthly dividend income:

Start with Index Funds:

Build your foundation

Learn market dynamics

Develop investing discipline

Add Undervalued Stocks (when ready):

Use small portions of your portfolio

Apply thorough research

Move profits to Index Funds as they grow

Transition to Dividend Stocks:

Start building your dividend portfolio around €500,000

Focus on companies with decades of dividend growth

Complete the transition by €1.5 million

read more about: Smart Investing and my 2:1 Strategy in article bellow

Smart Investing: Finding Balance Between Index Funds and Individual Stocks

The Bottom Line

Remember: Dividend investing isn't just another strategy - it's the destination. Everything else is just a means to get there. While others jump from strategy to strategy chasing returns, you'll be building a lasting income stream that could support generations.

Want to learn more about specific dividend stocks or building your foundation? Drop a comment below with your questions.

Stay in the loop and never miss our latest insights - subscribe now to join our community of forward-thinking investors!

If you enjoyed reading this post, please tap the Like button below ♥️

Thank you!

see ya, next time

Marjan