The Mathematics of Wealth: Why Risk-Reward Ratios Are More Important Than Returns

The Simple Math That Powers Long-Term Investment Success

Most investors obsess over potential returns while overlooking something far more important: the risk taken to achieve those returns.

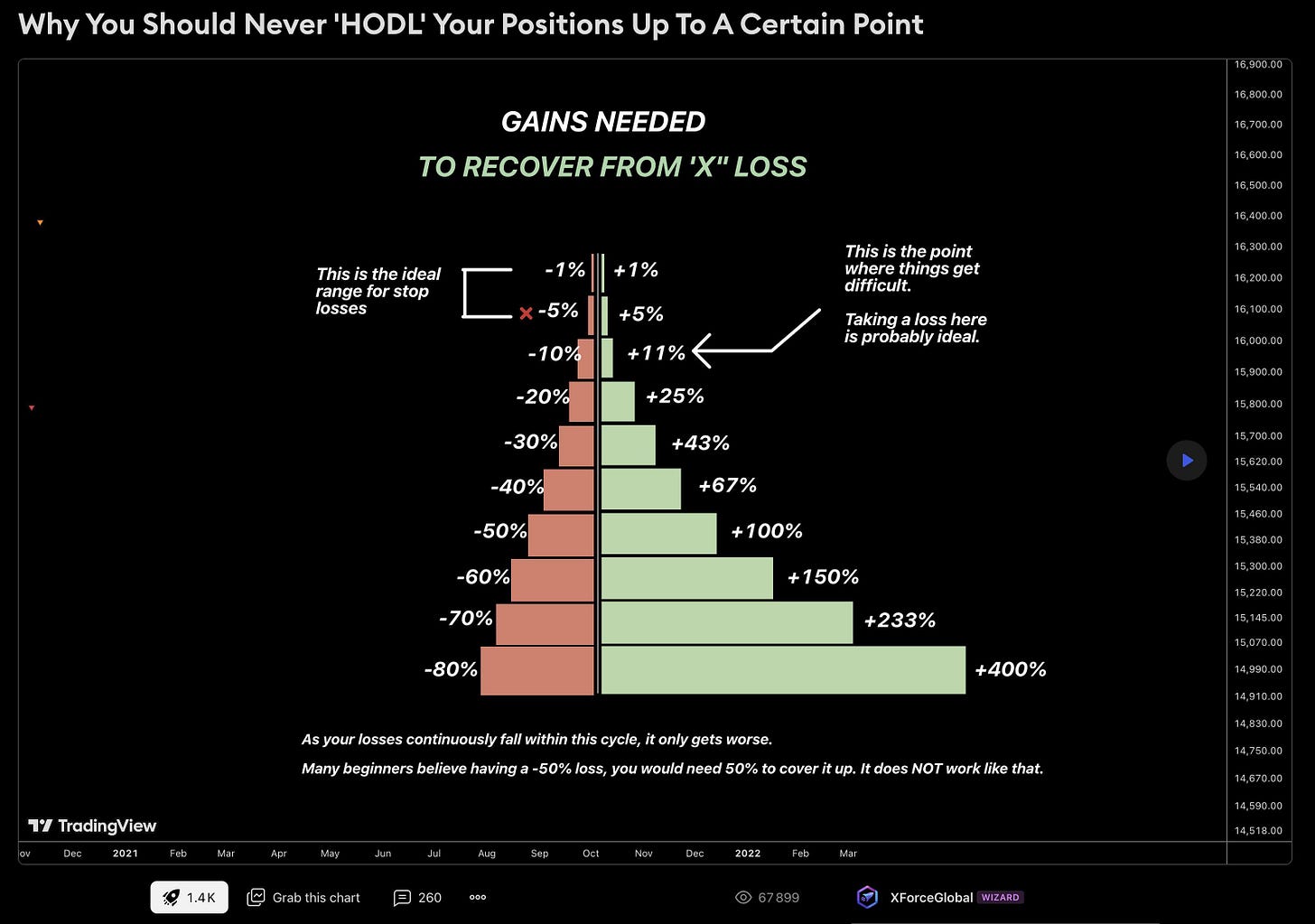

Consider this: If you lose 50% of your portfolio, you need a 100% gain just to break even. This mathematical reality is why focusing on downside protection is crucial for long-term wealth building.

Asymmetric investing flips the script by seeking opportunities with limited downside but substantial upside potential—situations where you might risk losing 10-20% but could gain 200-500% or more.

Image from Xglobalforce - XForceGlobal (@XForceGlobal) / XThis approach requires patience and discipline. You'll pass on many "hot" investments that don't meet your criteria. However, by focusing on asymmetric setups, you need far fewer winners to dramatically outperform the market.

Let me illustrate with a simple example:

Imagine you invest equally across 5 different sectors with asymmetric potential, putting 20% of your portfolio in each sector. Within each sector, you select 10 quality stocks.

If just one sector delivers a 100% return while the other four sectors perform poorly, how badly can those other sectors perform before your overall portfolio turns negative?

The math is illuminating:

One sector (+100%) contributes a +20% return to your overall portfolio

The remaining four sectors can each decline by -25% (contributing -20% total to your portfolio)

Your total portfolio return: 0%

This means that even if 80% of your chosen sectors perform terribly (down 25% each), but just one sector doubles, you'll still break even!

And that's assuming modest asymmetric returns. If your winning sector returns 200% or 300%, the other sectors can perform even worse while still leaving you solidly profitable.

The true power of asymmetric investing isn't just finding good investments—it's having the conviction to size positions appropriately when the odds are heavily in your favor.

Remember: The path to exceptional returns isn't about how often you're right, but how much you make when you're right versus how little you lose when you're wrong.

Stay in the loop and never miss our latest insights - subscribe now to join our community of forward-thinking entrepreneurs!

If you enjoyed reading this post, please tap the Like button below♥️ and give comment