If I Gave You €1M Today, What Would You Really Do With It?

A Reality Check on Financial Literacy and Why Most People Lose Their Fortune

Imagine getting €1M dropped into your account tomorrow. Exciting, right? But here's a sobering question: How long would it last?

I recently received a thought-provoking comment on my last article about dividend investing.

The Ultimate Guide to €5000 Monthly Investment Income: From High Risk to Royal Returns

The reader pointed out that hardly anyone has €1.5M available for investing. He'd worked for 30 years and had almost nothing saved.

The Truth About Building Wealth

Let me share something that might surprise you: If this reader had invested just €300 monthly for those 30 years (assuming a 10% average return in index funds), he would have accumulated approximately €592,000 today.

Let's break this down:

Monthly investment: €300

Time period: 30 years

Total invested: €108,000

End result: €592,000

or if he just add €200 more monthly and he could build a million-euro fortune

"But 30 years is such a long time!" I hear you say.

You're right. It is. And this brings us to a crucial point about financial literacy.

The Million Euro Test

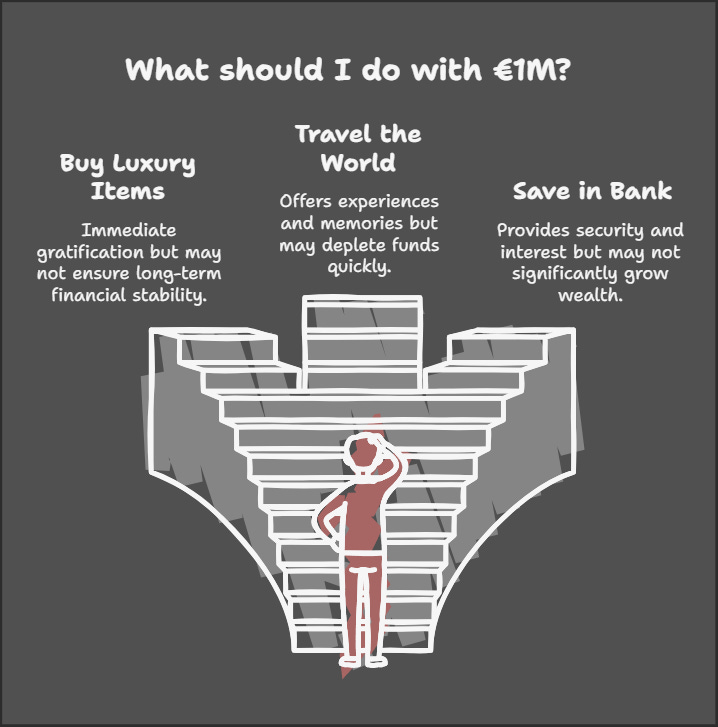

Here's a simple test of financial literacy: If I gave you €1M right now, what would you do?

Common answers I hear:

"Buy a fancy house and car"

"Travel the world"

"Put it in the bank"

"Start a business"

But here's the problem with these answers - they all lead to the same place: zero.

Why? Because without financial literacy, even €1M will eventually disappear. Let me explain:

The Bank Account Trap With current inflation at 4%, your €1M loses €40,000 in purchasing power every year. Just sitting there, doing nothing.

The Lifestyle Trap Spending €10,000 monthly might feel modest with €1M in the bank. But that burns through your fortune in just 8.3 years.

The Business Trap Starting a business without experience? 90% fail within five years.

Don't get me wrong - I'm all for entrepreneurship. But here's a smarter approach: First, build your dividend portfolio. Why? Because having €3,000-€5,000 flowing in monthly gives you a safety net. Then you can pursue your business dreams without the pressure of needing immediate profits. Think of dividends as your business backup plan - they keep paying you while you build your empire.

The Royal Solution

Remember our dividend strategy from the last post? Here's why it works:

€1M invested in dividend stocks yielding 4%

Annual income: €40,000 (€3,333 monthly)

Your capital stays intact

Dividends typically grow 5-10% annually

You're protected against inflation

"But €3,333 monthly isn't much for €1M!"

True. You could get more by gambling it all on risky investments. But remember:

The goal isn't to get rich quick

The goal is to stay rich forever

Breaking the 15-Year Barrier

"15 or more years is too long to wait!" I hear this often. But here's what people miss

Start Small, Start Now

Even €100 monthly is better than nothing

Increase investments as your income grows

Every €1 invested is a step toward freedom

Use the Three-Path Strategy (from our last post):

Index Funds for foundation

Undervalued stocks for growth

Transition to dividends for security

Smart Investing: Finding Balance Between Index Funds and Individual Stocks

The Real Difference Two people, same salary:

Person A: "I'll invest when I earn more"

Person B: "I'll invest what I can now"

After 15 years:

Person A: Still waiting to start

Person B: Building generational wealth

The Bottom Line

Financial literacy isn't about knowing how to make money - it's about knowing how to keep it. The difference between building wealth and staying poor often comes down to one simple choice: what you do with the money you have right now.

You might also like:

The Four Power Sectors Shaping the Next Decade: Your Guide to Future-Proof Investing

Smart Investing: Finding Balance Between Index Funds and Individual Stocks

The Ultimate Guide to €5000 Monthly Investment Income: From High Risk to Royal Returns

Stay in the loop and never miss our latest insights - subscribe now to join our community of forward-thinking investors!

If you enjoyed reading this post, please tap the Like or share button below ♥️

Thank you!

see ya, next time

Marjan